All Categories

Featured

Table of Contents

- – Where can I buy affordable Lifetime Income Ann...

- – Who offers flexible Deferred Annuities policies?

- – Who offers flexible Annuity Riders policies?

- – How do Annuity Contracts provide guaranteed i...

- – Why is an Senior Annuities important for my ...

- – How can an Retirement Annuities protect my r...

For those ready to take a little bit a lot more danger, variable annuities offer extra possibilities to expand your retirement assets and possibly enhance your retired life income. Variable annuities give a variety of financial investment choices managed by expert money supervisors. Consequently, financiers have a lot more flexibility, and can even relocate possessions from one choice to another without paying taxes on any type of investment gains.

* A prompt annuity will not have an accumulation phase. Variable annuities released by Safety Life Insurance Firm (PLICO) Nashville, TN, in all states other than New York and in New York by Safety Life & Annuity Insurance Firm (PLAIC), Birmingham, AL.

Investors need to very carefully consider the financial investment purposes, risks, fees and expenses of a variable annuity and the underlying investment alternatives prior to spending. This and various other information is had in the prospectuses for a variable annuity and its hidden financial investment choices. Programs might be acquired by getting in touch with PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a safety and security or stock exchange financial investment and does not take part in any type of stock or equity financial investments.

What's the difference between life insurance and annuities? The bottom line: life insurance policy can assist supply your liked ones with the monetary peace of mind they deserve if you were to pass away.

Where can I buy affordable Lifetime Income Annuities?

Both should be considered as component of a long-lasting financial strategy. Although both share some resemblances, the overall function of each is extremely different. Allow's take a glimpse. When comparing life insurance policy and annuities, the greatest distinction is that life insurance is made to help protect versus a financial loss for others after your fatality.

If you wish to find out a lot more life insurance coverage, researched the specifics of just how life insurance works. Think about an annuity as a device that can assist fulfill your retirement requirements. The primary objective of annuities is to produce income for you, and this can be carried out in a few different means.

Who offers flexible Deferred Annuities policies?

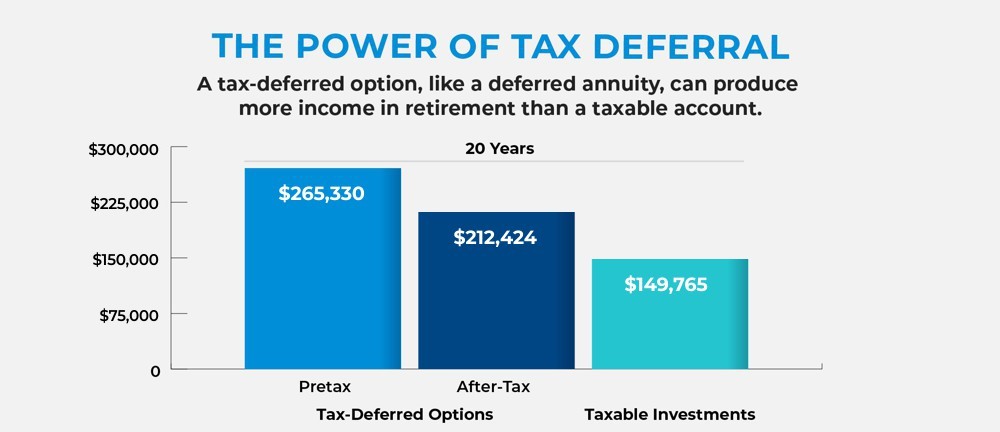

There are many possible benefits of annuities. Some consist of: The capacity to expand account worth on a tax-deferred basis The potential for a future income stream that can not be outlasted The possibility of a round figure benefit that can be paid to a surviving spouse You can buy an annuity by giving your insurance coverage company either a single round figure or making payments with time.

Individuals normally acquire annuities to have a retirement income or to build savings for one more function. You can buy an annuity from a licensed life insurance policy agent, insurance provider, monetary planner, or broker. You need to chat to an economic adviser concerning your demands and objectives prior to you buy an annuity.

Who offers flexible Annuity Riders policies?

The difference in between the 2 is when annuity settlements begin. You don't have to pay tax obligations on your incomes, or payments if your annuity is a private retirement account (INDIVIDUAL RETIREMENT ACCOUNT), till you take out the earnings.

Deferred and instant annuities provide a number of alternatives you can choose from. The choices give various levels of potential threat and return: are ensured to earn a minimal interest price.

enable you to choose between sub accounts that are comparable to common funds. You can make much more, but there isn't an ensured return. Variable annuities are higher danger because there's a possibility you could lose some or every one of your cash. Set annuities aren't as risky as variable annuities due to the fact that the financial investment danger is with the insurer, not you.

If performance is reduced, the insurance policy firm births the loss. Fixed annuities guarantee a minimum rates of interest, generally in between 1% and 3%. The business might pay a higher rate of interest than the ensured rate of interest. The insurance business identifies the rate of interest, which can alter monthly, quarterly, semiannually, or annually.

How do Annuity Contracts provide guaranteed income?

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are extra complicated than repaired deferred annuities (Retirement income from annuities).

Each depends on the index term, which is when the business calculates the interest and credit histories it to your annuity. The identifies just how much of the rise in the index will certainly be made use of to determine the index-linked rate of interest. Other crucial attributes of indexed annuities consist of: Some annuities cover the index-linked rate of interest.

Not all annuities have a flooring. All taken care of annuities have a minimum surefire value.

Why is an Senior Annuities important for my financial security?

The index-linked passion is included in your initial premium amount yet doesn't substance throughout the term. Other annuities pay substance rate of interest throughout a term. Compound rate of interest is rate of interest gained accurate you saved and the passion you earn. This implies that passion already attributed also earns passion. In either case, the rate of interest earned in one term is generally worsened in the next.

This percentage could be utilized as opposed to or along with an involvement price. If you get all your money before the end of the term, some annuities won't attribute the index-linked passion. Some annuities might attribute just part of the interest. The percent vested normally raises as the term nears completion and is always 100% at the end of the term.

How can an Retirement Annuities protect my retirement?

This is since you birth the financial investment danger rather than the insurance policy firm. Your representative or economic consultant can assist you make a decision whether a variable annuity is appropriate for you. The Securities and Exchange Commission identifies variable annuities as safety and securities because the efficiency is originated from stocks, bonds, and other investments.

Discover more: Retired life in advance? Consider your insurance policy. An annuity contract has two stages: an accumulation stage and a payment stage. Your annuity gains rate of interest during the build-up phase. You have several options on exactly how you add to an annuity, depending on the annuity you buy: enable you to pick the time and quantity of the settlement.

Table of Contents

- – Where can I buy affordable Lifetime Income Ann...

- – Who offers flexible Deferred Annuities policies?

- – Who offers flexible Annuity Riders policies?

- – How do Annuity Contracts provide guaranteed i...

- – Why is an Senior Annuities important for my ...

- – How can an Retirement Annuities protect my r...

Latest Posts

Analyzing Variable Vs Fixed Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuity Pros and Cons of What Is A Variable Annui

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Features of Fixed Vs Variable Annuity Pros And Cons Why Fixe

Understanding Financial Strategies Key Insights on Deferred Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Benefits of Fixed Income Annuity Vs Variable Growth Annuity Why Fix

More

Latest Posts