All Categories

Featured

Table of Contents

With a variable annuity, the insurer buys a portfolio of shared funds selected by the purchaser. The performance of those funds will certainly figure out just how the account expands and how large a payment the customer will at some point receive. Individuals who pick variable annuities want to take on some degree of risk in the hope of generating bigger earnings.

If an annuity purchaser is married, they can choose an annuity that will proceed to pay revenue to their spouse ought to they pass away. Annuities' payouts can be either instant or postponed. The standard concern you need to take into consideration is whether you desire routine earnings now or at some future date.

A deferred settlement allows the money in the account more time to expand. And similar to a 401(k) or an private retirement account (INDIVIDUAL RETIREMENT ACCOUNT), the annuity continues to gather earnings tax-free until the money is taken out. With time, that can develop into a considerable sum and lead to bigger payments.

There are some various other essential decisions to make in getting an annuity, depending on your circumstances. These include the following: Customers can set up for repayments for 10 or 15 years, or for the remainder of their life.

Exploring the Basics of Retirement Options Key Insights on Fixed Index Annuity Vs Variable Annuities Defining Annuities Fixed Vs Variable Features of Tax Benefits Of Fixed Vs Variable Annuities Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Risks of Variable Annuity Vs Fixed Annuity Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing Immediate Fixed Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Variable Vs Fixed Annuity A Beginner’s Guide to Variable Vs Fixed Annuities A Closer Look at Choosing Between Fixed Annuity And Variable Annuity

That could make good sense, for instance, if you require an earnings increase while paying off the last years of your home loan. If you're married, you can select an annuity that pays for the rest of your life or for the remainder of your spouse's life, whichever is much longer. The latter is typically described as a joint and survivor annuity.

The selection between deferred and prompt annuity payouts depends greatly on one's savings and future profits goals. Immediate payouts can be useful if you are already retired and you need an income to cover day-to-day expenditures. Immediate payments can begin as quickly as one month into the acquisition of an annuity.

People generally buy annuities to have a retired life income or to build financial savings for one more purpose. You can get an annuity from a certified life insurance policy representative, insurance provider, monetary planner, or broker. You should talk with a financial adviser regarding your requirements and objectives before you acquire an annuity.

The difference in between the 2 is when annuity repayments begin. You do not have to pay taxes on your revenues, or payments if your annuity is a private retired life account (IRA), till you withdraw the revenues.

Deferred and prompt annuities provide several options you can select from. The alternatives supply different levels of potential threat and return: are assured to make a minimal rate of interest. They are the most affordable economic threat yet provide lower returns. gain a higher rates of interest, but there isn't a guaranteed minimum rate of interest.

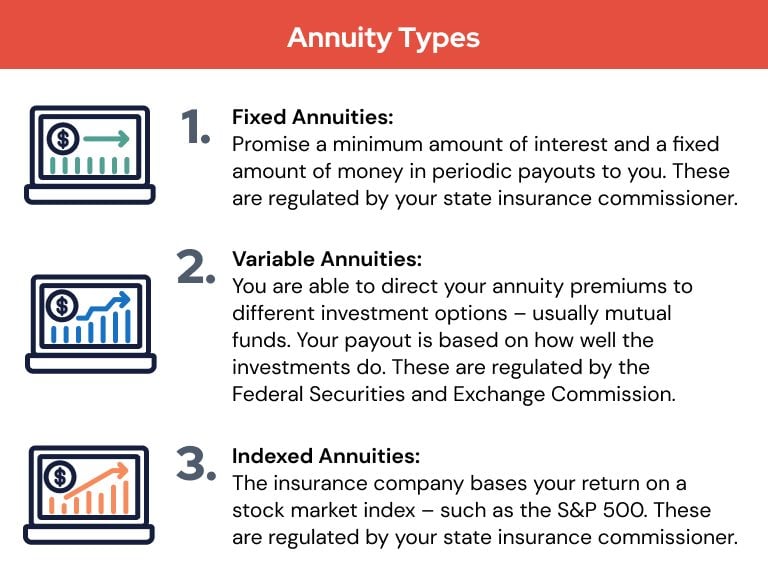

Variable annuities are higher danger since there's an opportunity you can shed some or all of your cash. Fixed annuities aren't as dangerous as variable annuities because the investment risk is with the insurance firm, not you.

Breaking Down Variable Annuity Vs Fixed Indexed Annuity A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between What Is A Variable Annuity Vs A Fixed Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Immediate Fixed Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

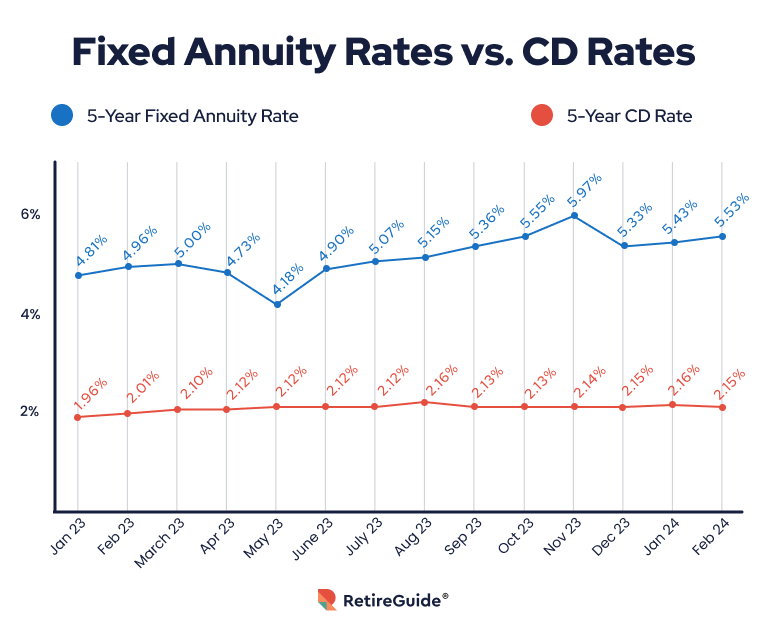

If efficiency is low, the insurer bears the loss. Fixed annuities ensure a minimum rate of interest, usually between 1% and 3%. The company could pay a greater passion rate than the guaranteed rates of interest. The insurance company identifies the rates of interest, which can alter regular monthly, quarterly, semiannually, or each year.

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are much more complicated than repaired delayed annuities.

Understanding Annuities Fixed Vs Variable A Comprehensive Guide to Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Fixed Annuity Vs Equity-linked Variable Annuity Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity Pros And Cons? Tips for Choosing Fixed Index Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

Each counts on the index term, which is when the firm calculates the rate of interest and credit scores it to your annuity. The identifies how much of the increase in the index will be made use of to calculate the index-linked passion. Various other important features of indexed annuities consist of: Some annuities cover the index-linked passion rate.

Not all annuities have a floor. All dealt with annuities have a minimum guaranteed value.

Exploring Indexed Annuity Vs Fixed Annuity A Comprehensive Guide to Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Index Annuity Vs Variable Annuities: How It Works Key Differences Between Choosing Between Fixed Annuity And Variable Annuity Understanding the Rewards of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Income Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Annuities Variable Vs Fixed Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Vs Variable Annuities A Closer Look at Fixed Index Annuity Vs Variable Annuity

The index-linked interest is contributed to your original premium amount but does not compound during the term. Other annuities pay substance passion during a term. Substance rate of interest is rate of interest gained on the money you conserved and the passion you earn. This suggests that passion already credited additionally makes rate of interest. In either case, the passion earned in one term is typically compounded in the following.

This portion may be utilized rather than or in addition to a participation rate. If you secure all your money before completion of the term, some annuities won't attribute the index-linked rate of interest. Some annuities could attribute only component of the rate of interest. The percentage vested normally increases as the term nears completion and is constantly 100% at the end of the term.

This is because you bear the investment danger as opposed to the insurance coverage business. Your agent or financial adviser can assist you decide whether a variable annuity is ideal for you. The Stocks and Exchange Commission categorizes variable annuities as securities because the performance is originated from stocks, bonds, and various other investments.

Discover more: Retired life ahead? Think concerning your insurance coverage. An annuity contract has two phases: a build-up stage and a payout phase. Your annuity makes interest during the accumulation phase. You have a number of alternatives on just how you add to an annuity, depending on the annuity you purchase: allow you to choose the time and quantity of the repayment.

permit you to make the same settlement at the very same period, either monthly, quarterly, or every year. The Irs (IRS) regulates the tax of annuities. The IRS permits you to delay the tax on incomes till you withdraw them. If you withdraw your earnings before age 59, you will most likely have to pay a 10% early withdrawal fine in addition to the taxes you owe on the rate of interest earned.

After the accumulation stage ends, an annuity enters its payment stage. This is sometimes called the annuitization phase. There are numerous choices for getting repayments from your annuity: Your firm pays you a fixed quantity for the time mentioned in the contract. The firm pays to you for as lengthy as you live, however there are none repayments to your successors after you die.

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Advantages and Disadvantages of Indexed Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Retirement Income Fixed Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Fixed Income Annuity Vs Variable Growth Annuity Who Should Consider Fixed Index Annuity Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Annuity Vs Variable Annuity

Several annuities charge a fine if you withdraw cash prior to the payout stage. This penalty, called a surrender charge, is normally highest possible in the early years of the annuity. The cost is often a percentage of the taken out money, and normally starts at about 10% and drops yearly till the abandonment duration is over.

Annuities have actually various other charges called loads or commissions. Often, these charges can be as high as 2% of an annuity's worth. Consist of these fees when estimating the price to purchase an annuity and the quantity you will certainly make from it. If an annuity is a good alternative for you, use these ideas to assist you shop: Premiums and advantages vary from firm to company, so speak to greater than one business and contrast.

Variable annuities have the potential for higher revenues, yet there's even more threat that you'll shed cash. Be mindful regarding placing all your properties into an annuity. Representatives and business need to have a Texas insurance coverage permit to lawfully offer annuities in the state. The issue index is an indication of a company's client service document.

Annuities marketed in Texas needs to have a 20-day free-look period. Substitute annuities have a 30-day free-look duration.

Table of Contents

Latest Posts

Decoding Fixed Income Annuity Vs Variable Growth Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Pros and Cons of Fixed Annuity Vs Equity-linked Variable Annuity Wh

Exploring the Basics of Retirement Options Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Fixed Annu

Analyzing Variable Vs Fixed Annuities Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Immediate Fixed Annuity Vs Variable Annuity Why

More

Latest Posts